Bietigheim-Bissingen, May 17, 2019 – The Dürr Group started 2019 posting substantial growth in sales and order intake. In the first quarter, the mechanical and plant engineering specialist achieved a 13.1% increase in sales to € 949.9 million, accompanied by an 8.5% increase in new orders to € 1,105.9 million. At € 54.6 million, operating EBIT fell slightly short of the previous year’s figure of € 56.8 million (down 3.9%). Earnings performance should accelerate as the year progresses. Ralf W. Dieter, CEO of Dürr AG: “We are confident of achieving our full-year targets. Although the economic environment is becoming more challenging, the pipeline of new capex projects on the part of our customers in the automotive industry is stable. As far as earnings are concerned, we expect to see improvements thanks to wider margins in paint shop business together with strict cost management and optimization measures.”

An important contribution to growth in the first quarter came from US environmental technology company Megtec/Universal, which had been acquired in October 2018. Adjusted for Megtec/Universal and currency-translation effects, Group sales climbed by 5.9% and order intake by 0.6%.

At € 394.1 million, order intake in the Paint and Final Assembly Systems division was above average (Q1 2018: € 274.2 million). In Mexico, Dürr was awarded a big-ticket order from a US automobile manufacturer for the construction of a paint shop, also receiving larger contracts in India and Algeria. The Clean Technology Systems division (environmental technology) and the Measuring and Process Systems division (mechanical engineering) likewise recorded higher new orders. Order intake by the HOMAG Group (Woodworking Machinery and Systems division) was good, coming to € 334.6 million, but as expected fell short of the previous year’s extraordinarily high figure (€ 415.2 million), which had been influenced by a large order.

The Dürr Group’s service business rose substantially by 21.6% in the first quarter of 2019, with sales coming to a very high € 272.8 million. This was underpinned by double-digit growth rates in all five divisions as well as by the consolidation of Megtec/Universal.

Adjusted for extraordinary expense, the operating EBIT margin came to 5.7% (Q1 2018: 6.8%). Including the extraordinary expense of € 6.0 million, which was mainly composed of purchase price allocation effects, EBIT came to € 48.6 million, resulting in an EBIT margin of 5.1% (Q1 2018: € 51.1 million / 6.1%). In paint systems engineering the upward trend in order margins continued. Together with the positive effects of the FOCUS 2.0 optimization program, this should lead to improved earnings in Paint and Final Assembly Systems over the next few quarters.

The cash flow from operating activities was negative at € -43.0 million in the first quarter of 2019; however, this is not unusual for Dürr at the beginning of the year. In any case, there was a clear improvement over the previous year´s period (€ 75.6 million). CFO Carlo Crosetto: “The cash flow from operating activities was in line with our expectations. We expect to see a substantial improvement in the second half of the year in particular and want to generate a higher cash flow than in the previous year over 2019 as a whole.”

At € 1,034.3 million as of March 31, 2019, equity exceeded the € 1 billion mark for the first time. The equity ratio widened by 0.8 percentage points over the end of the same quarter in the previous year, reaching 27.7%. Net financial status came to € 135.7 million. This substantial decline over the end of 2018 (€ +32.3 million) is primarily due to the application of the new accounting standard IFRS 16, which stipulates that lease liabilities must be recognized as financial liabilities from the beginning of 2019. This has increased the balance sheet total by € 89 million as leases were previously not normally placed on the balance sheet.

The headcount rose by 8.3% compared with March 31, 2018 to 16,415 employees. The main reason for this increase was the acquisition of Megtec/Universal with 853 employees. Half of the Group workforce was based in Germany as of March 31, 2019.

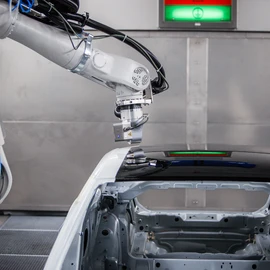

Ground-breaking innovation for two-tone painting of cars

Dürr has continued its innovation course with several new products, which were presented this week to over 1,000 guests from the automotive industry during the “Dürr Open House” in Bietigheim. One groundbreaking innovation is the EcoPaintJet robot painting system for the two-color painting of cars. Using a new applicator, it applies contrasting colors so precisely, e.g. on car roofs, that no overspray occurs and the car body no longer has to be covered with film. This eliminates the need for time-consuming manual work and at the same time reduces energy consumption by around 25%. Also on show were digital innovations for quality assurance and maintenance from the DXQ software range and the driverless EcoProFleet body transport system, which uses the DXQControl MES software to enable highly flexible material transport in paint shops.

Outlook

The outlook assumes that the economy will not slow to a greater extent than expected. Group sales should come to between € 3,900 and 4,100 million in 2019, thus reaching the € 4 billion threshold for the first time. The newly acquired Megtec/Universal Group, which will be consolidated for the first full year, should contribute sales of around € 150 million more than in 2018 (sales contributed in 2018: € 47.6 million). The Dürr Group is targeting order intake in a range of € 3,800 to 4,100 million. The EBIT margin should widen to 6.5 to 7.0 %. The extraordinary expenses included in EBIT will probably come to around € 25 million and primarily arise from purchase price allocation effects. Adjusted for extraordinary effects, the operating EBIT margin should reach 7.0 to 7.5 % in 2019. Improved earnings will be particularly underpinned by cost-cutting measures, which were stepped up in the first quarter. Among other things, they include a hiring freeze and a reduction in functional costs. As things currently stand, the cash flow from operating activities should widen. The headcount is expected to rise slightly by the end of 2019.