Financing linked to sustainability

Dec 5, 2019

Dürr takes on pioneering role

Dürr AG has broken new ground in Group refinancing: the mechanical and plant engineering firm has issued a sustainability-linked ‘Schuldschein’ worth € 200 million. It was thus the world’s first company to use this form of sustainability-oriented financing for a Schuldschein. Dürr AG also assumed a pioneering role when securing a syndicated loan of € 750 million in the year 2019. In both cases, the interest rate is linked to the Dürr Group’s sustainability rating.

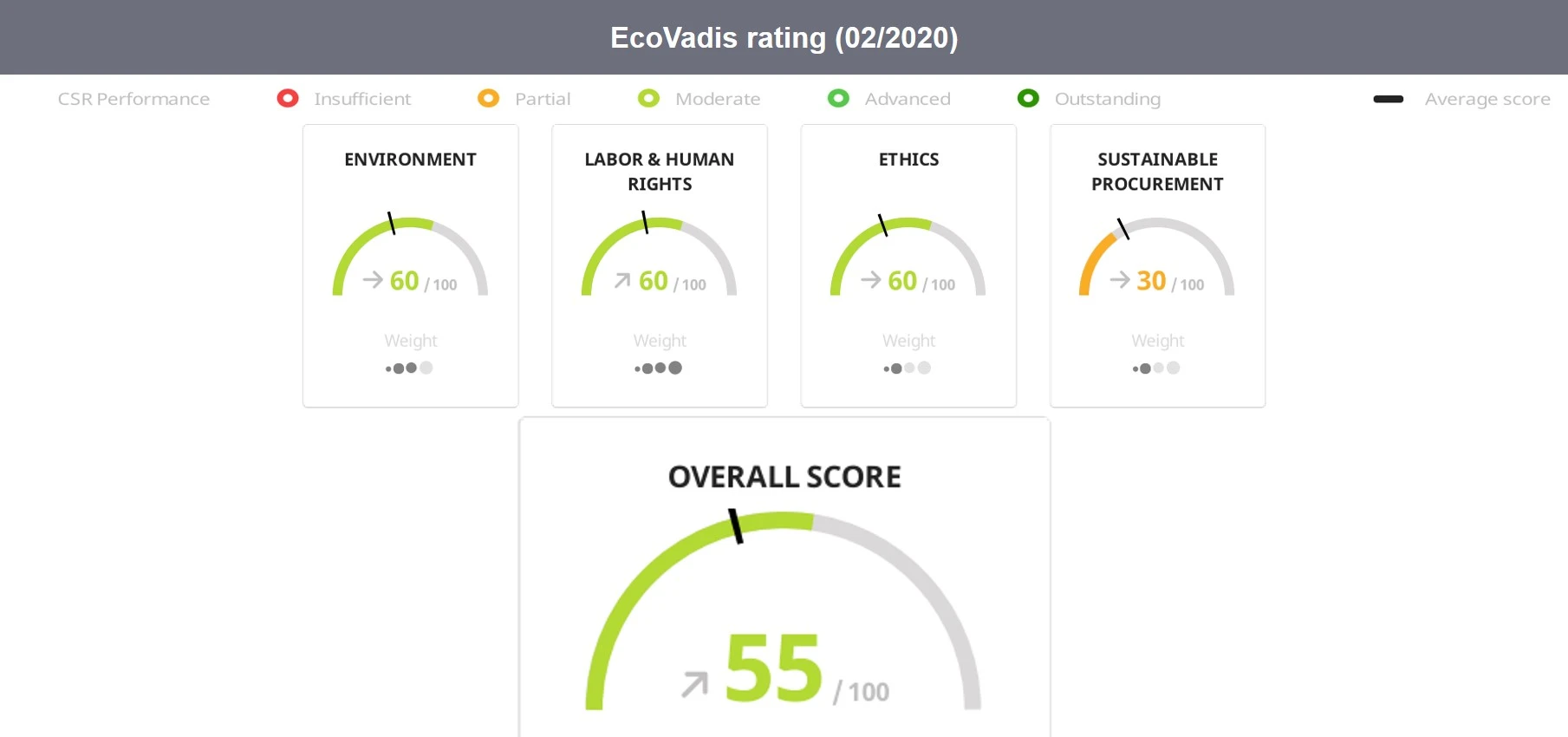

Interest rate linked to EcoVadis rating

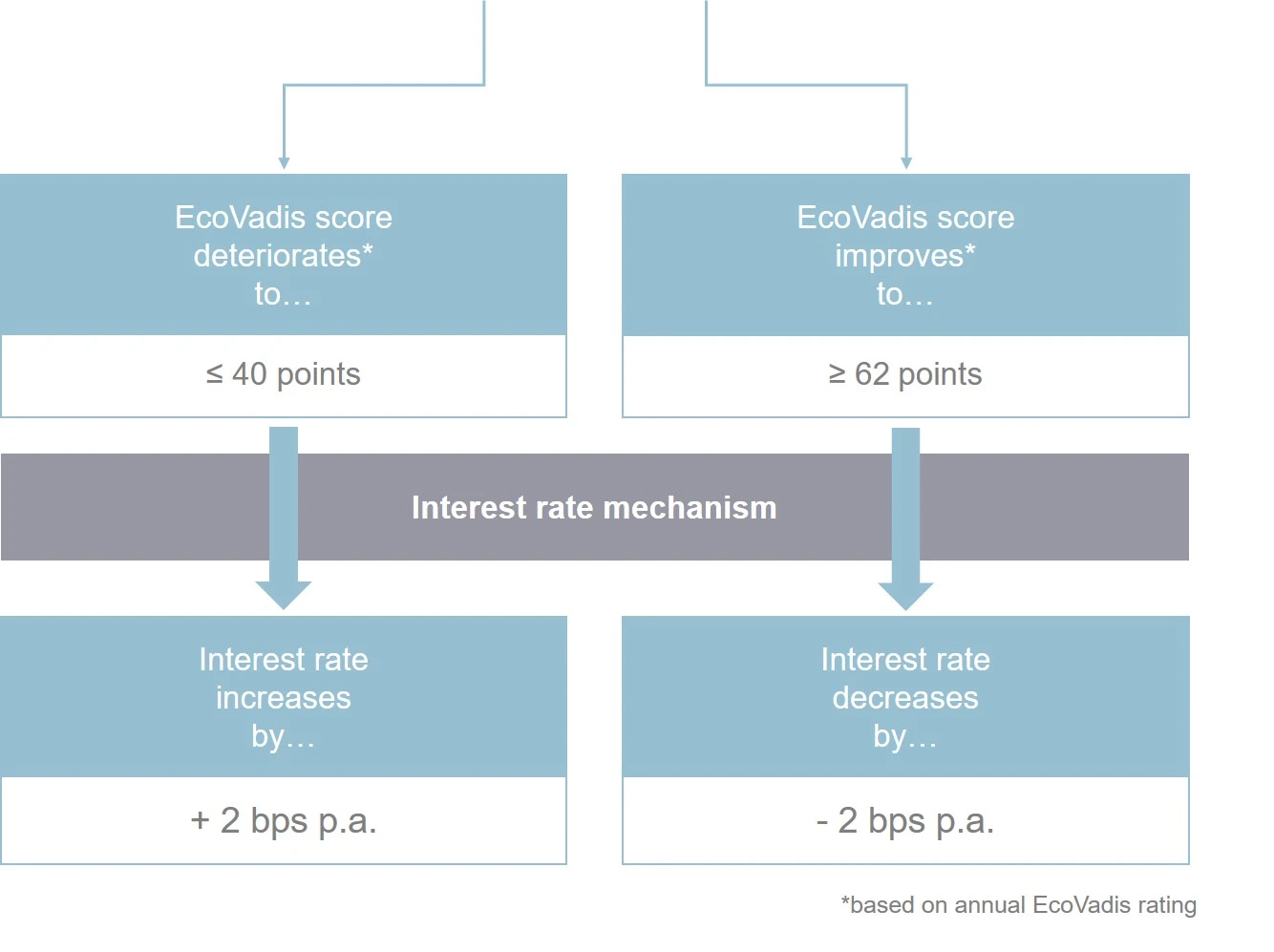

The interest rates of both the Sustainability Schuldschein and the syndicated loan partly depend on the Dürr Group’s sustainability performance: ecologically and socially responsible business operations will be rewarded through lower interest rates. The rating is published by the EcoVadis agency.

The Dürr Group currently has a sustainability score of 55 points, which corresponds to a Silver ranking. If the company improved its score to at least 62 points, it would lower its interest rate by 2 basis points. If, on the other hand, its sustainability score dropped to 40 point or less, the interest rate would increase accordingly.

Environment and human rights

EcoVadis considers the fields of environment, labor and human rights as well as ethics and sustainable procurement. The four fields are weighted differently and add up to a maximum score of 100 points. Based on 21 criteria, the agency takes into account ecology indicators such as energy and water consumption, CO2 emissions as well as anti-corruption measures and fair working conditions at suppliers. Within the mechanical and plant engineering industry, the Dürr Group is among the top 25% companies rated by EcoVadis.

Overall Score distribution in the machinery sector

Sustainability-Schuldschein

- The Dürr Group was the world’s first company to issue a sustainability-oriented Schuldschein loan.

- The interest rate depends on the company's sustainability performance as assessed by the EcoVadis rating agency.

- Term: 2021 - 2029

Syndicated loan with sustainability component

- The interest rate is linked to the sustainability rating published by EcoVadis.

- Term: until August 7, 2024