Outlook

Outlook continued operations

| . | 2024 reported | Forecast for 2025 | |

| Order intake | €m | 4,745.7 | 4,300 to 4,700 |

| Sales | €m | 4,290.9 | 4,200 to 4,600 |

| EBIT margin before extraordinary effects | % | 4.6 | 4.5 to 5.5 |

| EBIT margin | % | 3.6 | 3.5 to 4.5 |

| ROCE (annualized) | % | 11.4 | 10 to 15 |

| Free cash flow | €m | 129.6 | 0 to 50 |

| Capital expenditure (net of acquisitions) | % of sales | 4.4 | 3.0 to 5.0 |

In detail: outlook entire Group (continued + discontinued)

| . | 2024 reported | Forecast for 2025 | |

| Order intake | €m | 5,137.2 | 4,700 to 5,200 |

| Sales | €m | 4,698.1 | 4,700 to 5,000 |

| EBIT margin before extraordinary effects | % | 5.5 | 5.5 to 6.5 |

| EBIT margin | % | 4.4 | 4.5 to 5.5 |

| Earnings after tax | €m | 102.1 | 120 to 170 |

| ROCE (annualized) | % | 14.5 | 13 to 18 |

| Free cash flow | €m | 156.9 | 0 to 50 |

| Net financial status (December 31) | €m | -396.2 | -250 to -300 |

| Capital expenditure (net of acquisitions) | % of sales | 4.0 | 3.0 to 5.0 |

Outlook divisions

|

Order intake (€m) |

Sales (€m) |

EBIT margin before extraordinary effects (%) | ||||

| 2024 | Targets 2025 | 2024 | Targets 2025 | 2024 | Targets 2025 | |

| Automotive | 2,606 | 2,100 to 2,300 | 2,057 | 2,000 to 2,200 | 8.4 | 7.5 to 8.5 |

| Industrial Automation | 812 | 800 to 950 | 852 | 850 to 950 | 3.6 | 4.5 to 5.5 |

| Woodworking | 1,357 | 1,300 to 1,500 | 1,413 | 1,350 to 1,450 | 3.6 | 4.5 to 5.5 |

| Clean Technology Systems Environmental | 391 | Strong growth | 407 | Moderate growth | 15.2 | Stable |

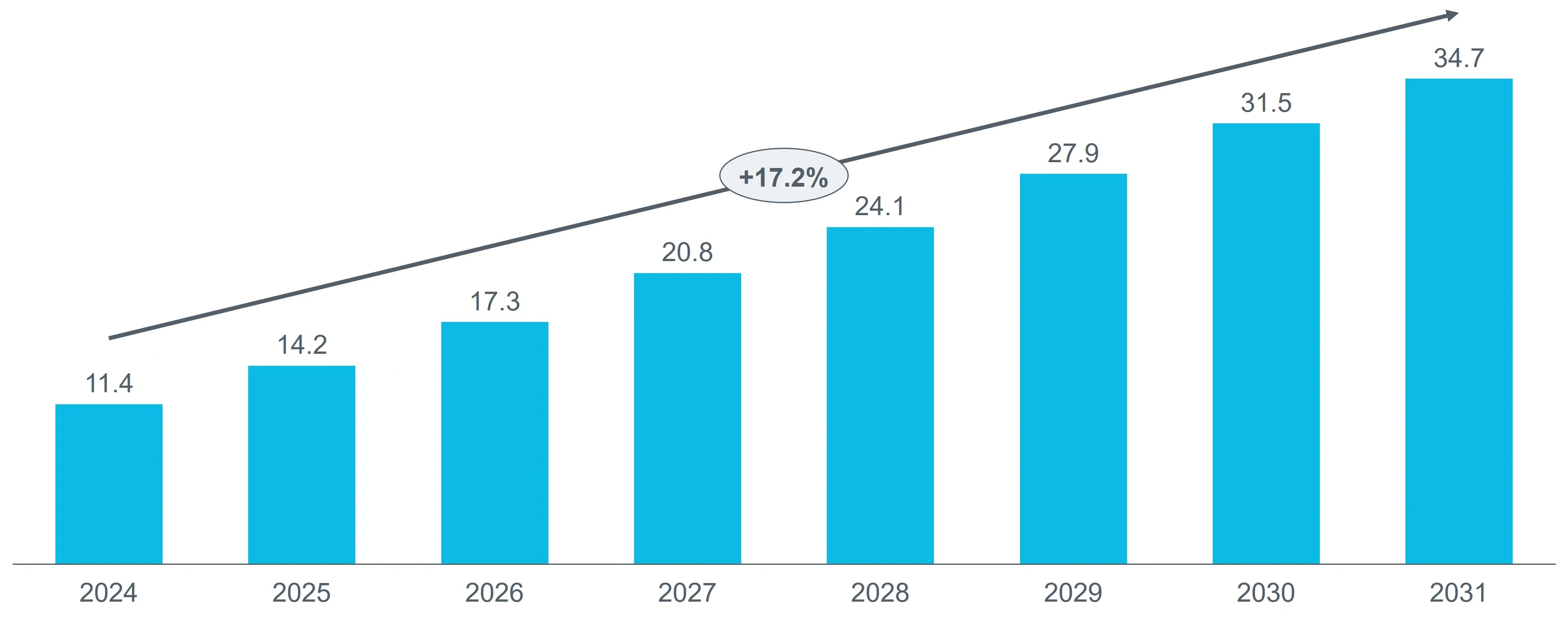

Worldwide production volume of BEVs

As a supplier of production lines, in particular for the automotive as well as the furniture industry, the Dürr Group depends on the investment behavior of the manufacturer. This is largely determined by the expected production in the coming years. One important driver here is the switch to electromobility.

in million vehicles

Source: GlobalData, Global Light Vehicle Powertrain Forecast - Quarter 1 2025

Dividend

Dürr intends in principle to distribute 30 to 40% of net income.

* All data was adapted after corporate actions (bonus shares) for better comparability.

Disclaimer

This publication has been prepared independently by Dürr AG/Dürr group. It may contain statements which address such key issues as strategy, future financial results, events, competitive positions and product developments. Such forward-looking statements are subject to a number of risks, uncertainties and other factors, including, but not limited to those described in disclosures of Dürr AG, in particular in the chapter “Risks” in the annual report of Dürr AG. Should one or more of these risks, uncertainties and other factors materialize, or should underlying expectations not occur or assumptions prove incorrect, actual results, performances or achievements of the Dürr group may vary materially from those described in the relevant forward-looking statements. These statements may be identified by words such as “expect,” “want,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. Dürr AG neither intends, nor assumes any obligation, to update or revise its forward-looking statements regularly in light of developments which differ from those anticipated. Stated competitive positions are based on management estimates supported by information provided by specialized external agencies.

Our financial reports, presentations, press releases and ad-hoc releases may include alternative financial metrics. These metrics are not defined in the IFRS (International Financial Reporting Standards). Net assets, financial position and results of operations of the Dürr group should not be assessed solely on the basis of these alternative financial metrics. Under no circumstances do they replace the performance indicators presented in the consolidated financial statements and calculated in accordance with the IFRS. The calculation of alternative financial metrics may vary from company to company despite the use of the same terminology. Further information regarding the alternative financial metrics used at Dürr AG can be found in our → financial glossary on the web page.