The cost of closing the micro gas turbine business, production bottlenecks at HOMAG, and additional consultancy costs will burden earnings by a total of around € 35 million in the second half of 2018. The Dürr Group is thus adjusting its earnings forecast and now expects an EBIT margin of 5.8 to 6.3 % for 2018. The previous target was 6.8 to 7.3 % (including US environmental technology companies MEGTEC and Universal, which have been consolidated since the beginning of October). The 2018 EBIT margin before extraordinary effects is now expected to reach 6.8 to 7.2 %; the previous target margin was between 7.4 and 7.8 %.

The optimization measures at Clean Technology Systems and HOMAG will have a positive effect on earnings as early as next year. Ralf W. Dieter, CEO of Dürr AG, states: "We are addressing two important issues, which have slowed down our earnings development in 2018. We are thus laying the foundation for a sustainable increase in earnings in 2019 and the subsequent years."

Clean Technology Systems starts with new structure, without earnings burden

The loss-making business in micro gas turbines, which generate electricity and heat, is part of the Clean Technology Systems energy-efficiency unit, established in 2011. The low demand for this technology, combined with high development costs, would have resulted in further substantial losses over the coming years. Says Ralf W. Dieter: "Firstly, the expectations we had placed in this technology were not fulfilled and, secondly, the demand for energy-efficiency systems is very limited due to low energy prices. This is why continuing this loss-making business would no longer have been acceptable."

Withdrawing from the micro gas turbine business will pave the way for a positive development of Clean Technology Systems. In its far larger core business of industrial exhaust-air purification technology, the division repositioned itself as a world market leader through the acquisition of MEGTEC/Universal at the beginning of October. The acquisition has caused sales at Clean Technology Systems to double to around

€ 400 million. Taking advantage of worldwide market opportunities and synergy potential should enable the division to increase sales to up to € 500 million, with the EBIT margin rising to between 6 and 7 %, by 2021. According to Ralf W. Dieter: "Clean Technology Systems is now in a good position: the acquisition of MEGTEC/Universal offers economies of scale and improved worldwide access to customers in exhaust-air purification technology. Eliminating the losses from the micro gas turbine business enables the division to pursue its growth targets unencumbered." The roughly 20 employees from the micro gas turbine business will be given the opportunity to move into other areas of the Dürr Group.

HOMAG prepares itself for growing systems business

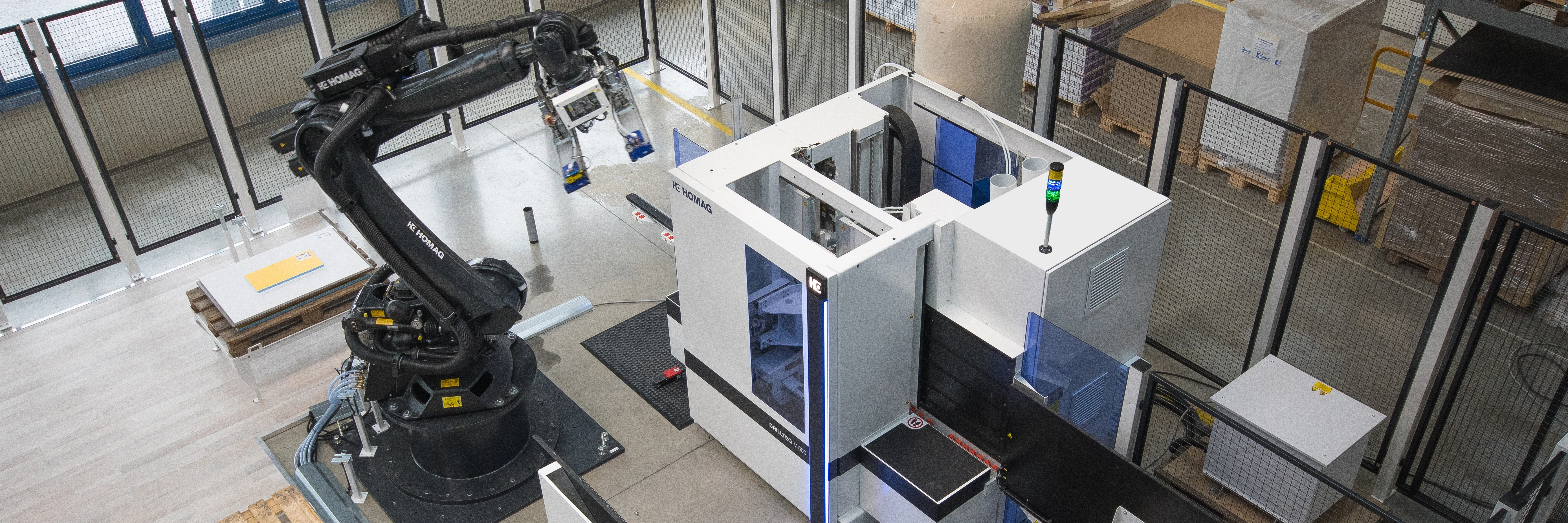

HOMAG is preparing itself for growth in systems business with complete lines for furniture production. At its Schopfloch headquarters, the company is fundamentally reorganizing its production, introducing an efficient production system to enable further growth. For automated and digitally networked production lines, HOMAG has built up a strong position over the previous years. It also benefits from the high demand for systems for efficient, batch size 1 production of customized furniture. In 2019, HOMAG expects another rise in sales with a margin increase. "HOMAG has made good progress with its optimization strategy. This is reflected in the substantial earnings improvements, which have been achieved continuously since 2014. The reorganization in Schopfloch is another important step in this direction", says Ralf W. Dieter. Sales and earnings at the other HOMAG sites are developing as planned. Further growth is expected over the coming years, although the pace of growth will be more moderate.

Forecast for incoming orders and sales for 2018 confirmed

The Dürr Group's targets for incoming orders (€ 3,650 to 3,950 million) and sales (€ 3,750 to 3,950 million) in 2018 remain unchanged and also take into account the effects from the acquisition of MEGTEC/Universal. In terms of cash flow, Dürr still aims to improve on the previous year’s figure.

Group targets for 2020 adjusted

Another large company acquisition is currently not envisaged at Dürr, due to the very high company valuations. Dürr has therefore adjusted its long-term Group targets for 2020, based on today's perspective. The sales target for 2020 is now between € 4,000 and 4,200 million, while the target range for the EBIT margin is 7.0 to 8.0 %. The previous targets of up to € 5,000 million (sales) and 8 to 10 % (EBIT margin) had implied another large company acquisition.