Bietigheim-Bissingen, February 23, 2023 — The Dürr Group posted new records in order intake and sales in 2022. Despite the challenging macroeconomic environment, orders increased sharply by 17% and, at €5,008 million, exceeded the €5 billion mark for the first time. Says Dr. Jochen Weyrauch, CEO of Dürr AG: “In 2022, we benefited greatly from the alignment of our technologies along the secular trends of sustainability, e-mobility and automation. Despite the economic headwinds, many customers are investing in these areas to ensure their long-term competitiveness. As a result, our business is exhibiting above-average resilience.” At €4,314 million, sales grew by 22% over the restrained previous year, exceeding the target range (€3,900 to €4,200 million). The EBIT margin before extraordinary effects reached 5.4%, thus coming within the target corridor that had been set in May (5.0% to 6.5%). Earnings after tax climbed by 58% to €134 million. At €117 million, free cash flow remained at the previous year’s high level (€121 million). This year, the MDAX-listed mechanical and plant engineering firm intends to grow profitably: “We entered the new year with a record order backlog and want to increase our sales by up to 11%. The EBIT margin before extraordinary effects is also to widen substantially to 6.0% to 7.0%,” says Dr. Jochen Weyrauch.

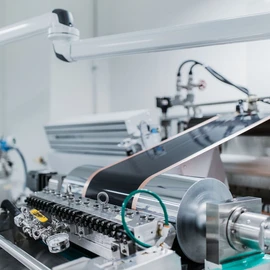

In its automotive business, the Group’s focus on electromobility paid off. Order intake for production technology for electric vehicles grew by more than 40% to a new high of over €1.1 billion. The Group also continued to grow its new business with battery manufacturers. In this segment, Dürr mainly supplies systems for electrode production, with new orders exceeding the threshold of €100 million for the first time. Newly established automation business with the Teamtechnik Group, which was acquired in 2021, also generated strong growth.

Technologies for sustainable production in demand

The trend toward sustainable production processes is an increasingly important growth driver. “More and more, sustainability is coming to the fore as an investment motive. Automotive OEMs have adopted ambitious decarbonization targets. To achieve these goals, they must adopt low-emission technologies for production steps such as painting. We are delivering the right solutions for this,” says CEO Weyrauch.

Group subsidiary HOMAG registered order intake of €1,706 million, thus repeating the previous year’s record figure (€1,713 million). Demand in the furniture production technology sector continued to boom in the first half of the year, before slowing as anticipated in the third quarter. Business in production facilities for climate-friendly wooden houses remains on a growth trajectory and accounts for almost 15% of HOMAG’s sales. Here, HOMAG is benefiting from the trend toward sustainable and automated construction and continues to see good prospects for continued growth.

Sales up in all divisions

Significant improvements in the supply chain situation in the second half of the year contributed to the strong growth in sales. At the same time, the less restrictive pandemic policy in China fueled sales momentum. The increase in sales was underpinned by all five Dürr Group divisions. Paint and Final Assembly Systems expanded the most swiftly, with gains of more than 30%. Service business grew by 8% to €1,219 million, accounting for 28% of sales.

EBIT before extraordinary effects climbed by 17% to €232 million despite the significant impact of high material prices, supply chain problems and strains caused by the spring lockdowns in China. A positive earnings trend emerged in the second half of the year, with EBIT and the EBIT margin before extraordinary effects reaching high figures of €84 million and 6.8%, respectively, in the final quarter.

Capital expenditure was boosted by 29% to €139 million. The main reason for this was the largest capital expenditure program in the HOMAG’s history, which includes capacity expansion, efficiency improvements and the construction of climate-friendly new buildings at several locations. Despite the increased capital expenditure, free cash flow (€117 million) was slightly higher than expected (€50 to €100 million). Says CFO Dietmar Heinrich: “The high cash flow is the result of disciplined net working capital management. Although we had to increase inventories in response to supply chain problems, we were able to reduce net working capital. One important factor in this regard was that we were able to collect high prepayments as a result of our strong order intake.” As cash and cash equivalents rose by 23% to €716 million, net financial liabilities stood at a very low €46 million at the end of 2022.

18,500 employees

The Dürr Group had 18,514 employees as of December 31, 2022, up 712 or 4.0% over the end of 2021. At 5%, HOMAG recorded the sharpest increase. In Germany, employee numbers grew by 2.4% to 8,853. Currently, around 500 young people are completing apprenticeships or work-study programs at the Dürr Group.

Outlook

The outlook for 2023 assumes that growth in the global economy does not fall short of expectations, supply chains continue to stabilize and the geopolitical uncertainties do not worsen.

The Dürr Group entered the year with a very high order backlog worth €4,014 million. On this basis, sales are expected to increase to €4,500 to €4,800 million in 2023. Following the record figure in 2022, the Dürr Group’s order intake should decline somewhat and come within a corridor of €4,400 to €4,800 million. In this connection, it should be borne in mind that HOMAG’s order intake is likely to weaken after the exceptionally strong year in 2022 due to more muted demand in the furniture sector. In automotive business, the strong demand is expected to continue. In this respect, Dürr will focus on high-margin orders under its “value before volume” strategy.

The EBIT margin before extraordinary effects should reach 6.0% to 7.0% in 2023, underpinned by high capacity utilization, the margin quality of the order backlog, the improved supply chain situation and the planned expansion of service business. The Board of Management assumes that earnings after tax will climb to €160 to €210 million. As things currently stand, free cash flow looks set to reach €50 to €100 million.

The figures in this report are provisional and unaudited. They have not yet been approved by the Supervisory Board. The annual report for 2022 setting out the final figures will be published on March 16, 2023.