Bietigheim-Bissingen, November 4, 2021—The Dürr Group remains headed for a new record in order intake. Orders increased again in the third quarter, reaching €1,095.1 million. Sales and the EBIT margin also increased to their highest levels since the beginning of the year. In the first nine months, order intake rose by 38.8%, reaching a new high of €3,205.9 million. In view of this, the upper end of the full-year target range of €4,000 to 4,200 million appears well within reach. “We are heading for a new record in orders. The outlook for the fourth quarter is also upbeat, with the pipeline amply filled with new projects due to be awarded by our customers,” said Ralf W. Dieter, CEO of Dürr AG. Despite some supply chain constraints, sales rose by 10.5% in the third quarter to €900.8 million. This marks an improvement over the first and second quarters, in which the previous year’s pandemic-induced decline in orders left deeper traces on sales. Sales came to €2,533.7 million in the first nine months of the year (up 4.2%). The EBIT margin before extraordinary effects continued on its upward trajectory in the third quarter and, at 6.4%, exceeded the full-year target corridor (5.0 to 6.0%). “Demand in our markets has largely recovered from the previous year’s pandemic shock. Our high order intake puts us in a good starting position for further profitable growth in 2022,” says Dürr CEO Dieter.

Order intake displayed double-digit growth rates in all market regions in the first nine months following a significant decline in the previous year due to the pandemic. The greatest contribution was made by Group subsidiary HOMAG, which specializes in woodworking machinery. The division’s order intake rose by 82.2% to €1,389.9 million in the first nine months, thus exceeding the full-year figure for 2019. New orders reached a record €503.2 million in the third quarter. In addition to strong demand in the furniture industry, HOMAG also benefited from the trend in favor of the use of timber in construction. The Dürr Group also recorded significant growth in its business in production technology for the automotive industry and in environmental technology compared with the pandemic year of 2020.

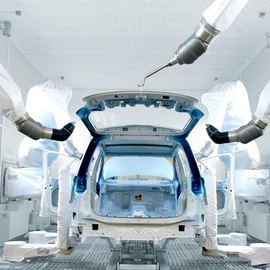

Sales in the first nine months were also spurred by HOMAG’s good performance (up 22.0%). In addition, the Group achieved gains in painting robot technology (Application Technology) and balancing technology (Measuring and Process Systems) following a strong third quarter. Another important growth driver was service business, which expanded by 19.5%, thus significantly outpacing total sales. Service business accounted for €803.8 million or 31.7% of total sales.

The companies acquired since October 2020 contributed €170.7 million to order intake and €144.6 million to sales. These include automation specialists Teamtechnik and Hekuma, the joint venture HOMAG China Golden Field, which was taken over in full, Danish wood machinery manufacturers System TM and Kallesoe and Canadian IT specialist Cogiscan.

The EBIT margin before extraordinary effects has improved from quarter to quarter in the current year, standing at 5.4% after the first nine months. In absolute terms, EBIT before extraordinary effects more than doubled to €136.5 million in the first nine months. This performance was underpinned by an improvement in the gross margin to 23.4% (9M 2020: 18.8%) despite the fact that the global supply chain problems caused additional costs in some areas. The improved margin was mainly the result of cost reductions and efficiency-boosting measures as well as the growth in service business. At €49.0 million, earnings after tax rose almost four-fold despite the fact that financial result included one-time non-cash expenses of € 14.2 million.

Driven by the upbeat earnings performance, free cash flow came to €94.2 million, thus coming close to the previous year’s high level (€105.3 million) in spite of the recent increase in net working capital due to the business recovery. “Our cash flow has been very robust in the year to date, as stockpiling and the increase in receivables has been largely offset by high cash inflows from projects,” said CFO Dietmar Heinrich. Net financial debt stood at a moderate €127.1 million as of September 30 despite the purchase price payments for the acquired companies. Total liquidity came to a very solid €821.2 million.

The Dürr Group had 17,560 employees as of September 30, 2021, an increase of 6.3% over the end of 2020. The growth is a result of the acquisitions, which added a total of around 1,000 employees. On the other hand, jobs were cut in other areas as announced. Almost half of the workforce (8,588 people) were based in Germany.

Outlook for 2021 confirmed

The outlook assumes that the global economy will continue to recover from the impact of the pandemic and that the global supply chain bottlenecks will not worsen any further by the end of the year. Order intake is expected to come in at the top end of the target corridor for 2021 (€4,000 to 4,200 million). Sales look set to pick up momentum in the final quarter of the year and should reach a full-year range of €3,600 to 3,800 million. However, supply chain constraints may continue to have adverse effects. EBIT will benefit from the efficiency and capacity measures initiated in 2019 and 2020. The target EBIT margin stands at 5.0 to 6.0% before extraordinary effects and 4.1 to 5.1% after extraordinary effects. As things currently stand, both targets appear well within reach. Following its gratifying cash flow performance in the year to date, the Dürr Group is still projecting full-year free cash flow of €50 to 100 million.

The Board of Management expects the profitable growth to gain momentum in 2022, materially underpinned by the high order intake in the current year and the resultant large orders on hand at the end of the year. Sales and EBIT margin should exceed the pre-crisis figures of 2019 (€3,921.5 million and 6.7% before extraordinary effects) in 2022. The medium-term target of an EBIT margin of at least 8% should be achieved by 2023 or 2024 at the latest.